City of Falfurrias Fiscal Year 2014

Budget Cover Page

January 1, 2014

This budget will raise less revenue from property taxes than last year’s budget by an amount of $5,610, which is a -1.41 percent decrease from last year’s budget. The property tax revenue to be raised from new property added to the tax roll this year is -$5,610.

The members of the governing body voted on the budget as follows:

FOR:

- Mayor Pro-Tem - Letty Garza

- Alderwoman Sandra B. Gonzalez

- Alderman Roberto J. “Bobby” Villarreal

- Alderman Roberto “Bobby” Benavides

- Alderwoman Miriam Fernandez

AGAINST:

- None

PRESENT and not voting:

- None

ABSENT:

- None

Property Tax Rate Comparison |

2014 |

2013 |

| Property Tax Rate: | $0.5000/100 | $0.5000/100 |

| Effective Tax Rate: | $0.5057/100 | $0.4965/100 |

| Effective Maintenance & Operations Tax Rate: | $0.5462/100 | $0.5689/100 |

| Rollback Tax Rate: | $0.5462/100 | $0.5689/100 |

| Debt Rate: | $0.0000/100 | $0/100 |

Total debt obligation for City of Falfurrias secured by property taxes: $0

January 1, 2014

Mayor Pro-Tem Letty Garza/

Board of Aldermen

City of Falfurrias

205 E. Allen Street

Falfurrias, Texas 78355

Re: Fiscal Year (FY) 2014 Annual Budget Letter

Dear Honorable Mayor, Board of Aldermen, and Citizens:

Toward the end of fiscal year 2012, the Falfurrias City government experienced change. Faced with the challenge of a retiring City Clerk, a regional economic downturn, a loss of population over the years, the development of Highway I-69 through Falfurrias, and a focus on the sustainment of the City’s financial stability, the Mayor and Board of Aldermen voted to create the position of City Administrator. City leaders felt there was a need to have a clear path in sight and decided to appoint a professional administrator to oversee the planning and implementation of objectives that will benefit Falfurrias for years to come. The decision was not easy, and with change comes uncertainty. However, City leaders felt that the challenges and tasks laid out before them will best be accomplished by having a professional manager. I commend the Mayor and Board of Aldermen for doing what they think is best for Falfurrias. I am honored to serve as the City’s First-Ever City Administrator.

As your City Administrator, and public servant, my priority has been, and will be, to uphold professional management through the values of professionalism, integrity; honesty, transparency, and accountability which have become the expectation of every City employee. This applies to me as much as to the newly hired municipal court deputy clerk. Each employee understands they represent Falfurrias and that by functioning as a team, every individual is to take ownership of his or her duties, be held responsible for their role in each initiative, and will be treated with dignity and respect.

By applying the aforementioned principles, we have moved forward toward understanding the needs of the City, the objectives of the Board of Aldermen and, ultimately, our citizens. The City finalized a Comprehensive Plan study in August 2012 that was completed by Grantworks Inc. through a Texas Department of Agriculture (TDA) Planning and Capacity matching grant of $60,000. The grant portion was $50,000 and the City’s match was $10,000. The data provided by the study has become the foundation for the completion of the City’s First-Ever 20-year plan. As fiscal year 2013 comes to a close, we will proceed with introducing the various components of the 2013-2033 Falfurrias Comprehensive Plan, Falfurrias Forward. We believe that with effective civic engagement, the final plan will be representative of all Falfurrias stakeholders.

As City Administrator, I would like express my thanks to the entire City staff and to the honorable Mayor and Board of Aldermen for their sacrifice, support, and belief that through sound decisions based on careful planning, the City of Falfurrias will begin on a progressive path toward achieving its short-term and long-term objectives, into a better future for Falfurrias.

The proposed 2014 Fiscal Year Annual Budget is hereby submitted for the City of Falfurrias, Texas. The adoption of the annual budget represents a one-year financial plan that in the future will be derived from a longer term financial plan representing the vision of our City leaders, staff, and citizens. This budget represents the state of financial affairs which includes the projected revenues and expenditures for Fiscal

Year beginning January 1, 2014 and ending December 31, 2014.

The budget has been prepared in conformance with the City’s financial policies and appropriate State law. Budget workshops were held on August 15th, August 29th, September 10th, and September 23rd, respectively. The first public hearing on the City’s tax rate was held on September 23rd. The second public hearing for the review and adoption of the proposed 2014 budget and tax rate was held on October 2, 2013. The final adoption of the budget and tax rate was also held on October 2, 2013.

The annual budget is more than a projection of revenues and expenditures for the forthcoming year; it is a financial plan of action which will provide services to the citizens of Falfurrias. The operating budget for Fiscal Year 2014 is conservative with modest financial growth in the General Fund to strengthen and maintain existing city services, and to include projects that will build momentum as we finalize the Comprehensive Plan. This budget is also a step forward in building the City’s fiscal strength and enables City staff to focus on providing high quality services. The highlights of the 2014 budget include:

- Establishment of a Special Projects fund for the transparency and accountability of the amusement machines revenues;

- Establishment of the General Fund reserve requirements via Ordinance No. 576;

- 2014-2018 Capital Improvement Plan (CIP) for public works and police department equipment, parks upgrades to Tony Lemus Park;

- Appropriation of funds for New City website, and Employee classification plan and comprehensive salary study;

- Funding toward a landfill position for Brooks County via Interlocal Agreement;

- Funding for a grant application for Texas Water Development Board’s (TWDB) Flood Protection Planning Grant Study (City will engage services of eCivis for professional grant writing services);

- Funding for replacement and upgrading of Street Signs throughout the City;

- Funding for the Highway 281 Aluminum Wall Art to be located at the intersection of Hwy. 281 and Hwy 285 in Downtown Falfurrias;

- Implementation of plans to convert fiscal year from existing calendar year dates of Jan. 1st – Dec. 31st to Federal and State fiscal year dates of Oct. 1st – Sept. 30th;

- Continued funding for a Full-Time Code Enforcement Position; and funding for a Full-Time Building Inspector staff position.

The 2014 fiscal year total combined budget revenue plus beginning fund balance equals $4,227,372.00 million and total budgetary expenditures are estimated at $3,095,111.00 million. The Operating Budget presents an overview of the revenues, expenditures and changes in fund balance for the funds budgeted.

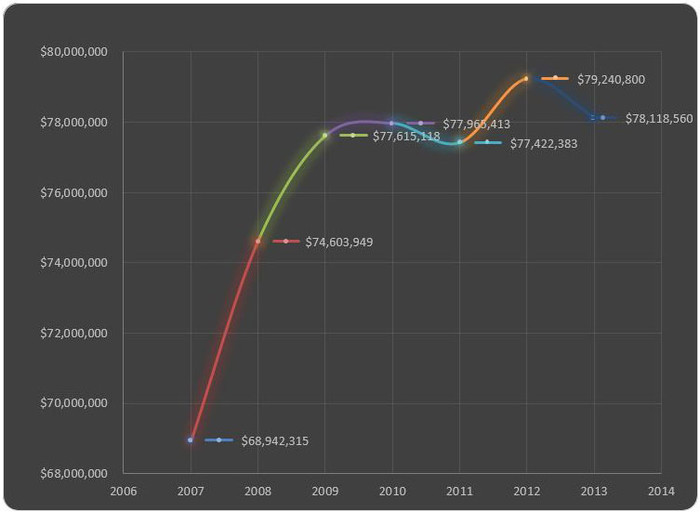

Property Values

According to the Brooks County Appraisal District, the final assessed property value for 2013 equals $78,118,960 million which equates to an overall decrease of $1,121,840 million from the previous year of $79,240,800.00.

Tax Rate

| M & O | I & S | ||

| 2012 | $ 0.5000 | 0.5000 | 0.0000 |

| 2011 | $ 0.5000 | 0.5000 | 0.0000 |

| 2010 | $ 0.4700 | 0.4700 | 0.0000 |

| 2009 | $ 0.4500 | 0.4500 | 0.0000 |

| 2008 | $ 0.4200 | 0.4200 | 0.0000 |

The recommended budget proposes no change in the City’s tax rate of $0.5000 and continues the City’s commitment to providing high quality services. The City is preparing for its future obligations by developing a 5-Year Capital Improvements Program (CIP) that will be based on the City’s 20-Year Comprehensive Plan. The CIP is a financial plan that will guide the City in its future development plans.

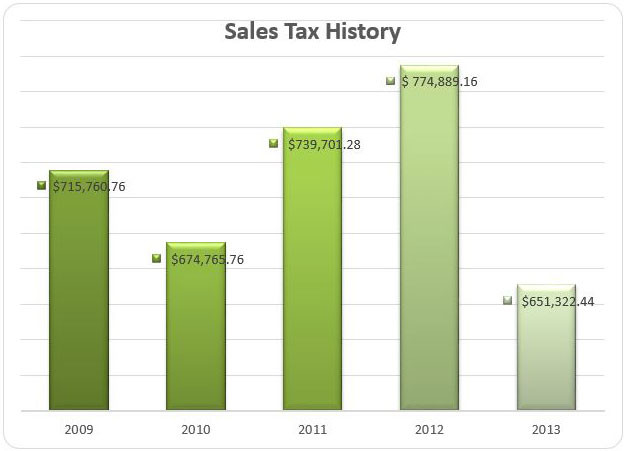

General Fund

The general fund accounts for all expenditures of traditional government services. This fund finances operations such as Public Safety, Administration, Community Services, Parks and Recreation, Municipal Court, Public Works, Animal Control, Code Enforcement, and Streets Departments. The City is also considering the establishment of an Economic Development Corporation (EDC) through Ordinance that will be funded through sales tax. The EDC will follow 4B guidelines and will allow the City to appropriate any designated amount of funding from General Fund for economic development projects. This will allow the City flexibility by not having a designated percent of sales tax transferred out of General Fund. General Fund revenue is generated from ad valorem property taxes, a 1.25% cent portion of the sales tax, and a variety of fees for services.

The sales tax remains at the rate of 8.25% with 1.25% contribution to the City of Falfurrias’s General Fund. The allowable State maximum for municipalities is 8.25% which grants the City a 1.25% contribution to the General Fund. The City is focused on continued commercial development by maximizing the opportunity of Interstate – 69 (I-69) in Falfurrias.

General Fund operating expenditures and budget transfers total up to be $118,000 from the City’s Utilities Fund which is composed of revenues from Water, Sewer, and Gas services. The total ending fund balance for the General Fund is $1,132,000.

Debt Service

The Debt service Fund is established by Ordinances authorizing the issuances of General Obligation (GO) bonds or Certificates of Obligation (CO) bonds. The fund provides for payment of bond principal, interest, paying agent fees, and a debt service reserve as a sinking fund each year. An ad valorem tax rate and tax levy is required to be computed and levied, which will be sufficient to produce the money required to pay the principal and interest as it comes due and provide the interest and sinking fund reserve.

The City of Falfurrias has no current debt service to be paid via ad valorem taxes. However, the City had an issuance of GO refunding bonds for the Falfurrias’s Utilities Board outstanding United States Department of Agriculture (USDA) revenue bond obligation of $3,002,000.00. By executing the refinance, the City of Falfurrias will be providing that payment of the bonds be made by pledging a levy of an ad valorem tax upon all taxable property within the City, should the City default on its payments. The GO bonds, however, will continue to be paid from utilities revenue. The refinance has afforded the City a lower interest rate from 4.125% to 3.6%, cash flow savings of $1,700,000 from principal and interest, will allow for a potential consolidation of the City Utilities systems into a department for greater efficiency and cost-effectiveness, and shortened the payback period from thirty-three (33) years to fifteen (15).

Solid Waste

Solid Waste represents the financial activity related to solid waste collection and disposal, including trash and the management of household hazardous waste. The anticipated revenues in fiscal year 2014 are $765,000 with budgeting expenses totaling $540,540. The anticipated revenues include a 5% adjustment to Solid Waste rates due in early 2014. In addition, the City has been presented with a proposal for Brush Collection services that will be deliberated and potentially implemented in late 2013 for residential customers. The total ending departmental balance is projected to be $224,460. Consistent with prior Board discussion, in fiscal year 2014 the Solid Waste balance will absorb the costs of a 2.96% Consumer Price Index (CPI) cost increase that is contractually due to Waste Connection Services of Texas cost increases.

During fiscal year 2014, the City will begin its efforts to keep Falfurrias clean with City sponsored City-Wide Clean-Ups. The City will continue to take proactive steps toward maintaining and beautifying the community.

Conclusion

Balancing the needs of the community with available financial resources presented a challenge in the development of the budget. The operating budget reflects the efforts of the Board of Aldermen and City staff to address the need to provide services and facilities to our citizens while working to secure a strong financial position for the long-term. The budget is a blueprint of the goals and objectives of the Mayor and Board of Aldermen for Fiscal Year 2014. Please stay tuned for the unveiling of the New City Website as the City aims at improving the transparency and accountability to its citizens.

I once again extend my thanks to the Mayor, Board of Aldermen and City staff for all their time and work in the preparation of the budget. The budget is a result of the City staff and elected officials who continue to work hard at improving the delivery and quality of services to our citizens in the City of Falfurrias.

Respectfully Submitted,

Noel Bernal

City Administrator